Wavebridge Collaborates with Solana Foundation on KRW Stablecoin and MMF Tokenization

In Korea’s evolving regulatory landscape, the collaboration seeks to build compliance-ready infrastructure for real-world use cases of digital assets

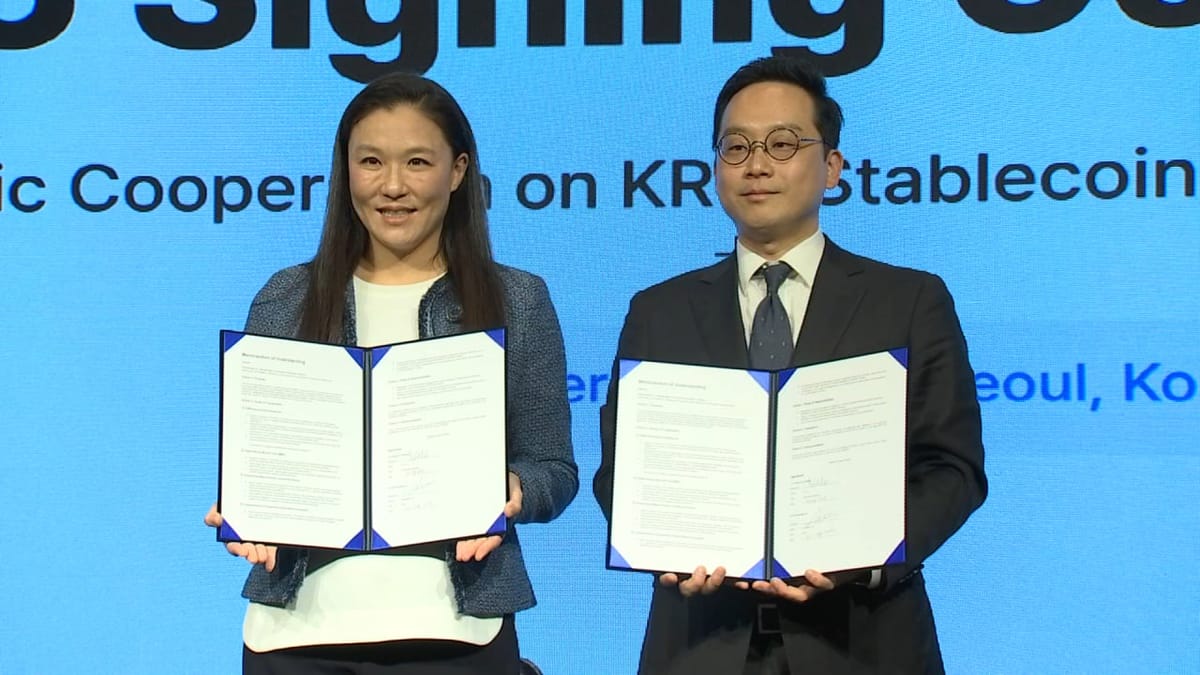

Seoul, October 14, 2025 — Wavebridge Inc., a Korea-based digital asset financial infrastructure provider for institutions, announced that it has signed a Memorandum of Understanding (MoU) with the Solana Foundation, a non-profit dedicated to the decentralization, adoption, and security of Solana.

Unlike earlier attempts at issuing KRW stablecoins—mostly limited to exchanges or fintech players with limited scale—this collaboration focuses on combining a high-performance global blockchain with compliance-by-design architecture. The aim is to raise stablecoins to a level where they can be trusted and eventually adopted within regulated financial markets.

Under the MoU, the parties will:

- Develop a KRW Stablecoin Tokenization Create an engine covering the full lifecycle of a KRW stablecoin with features like whitelist management, transfer controls, and audit flows. Wavebridge leads regulatory and operational design, leveraging Solana’s blockchain infrastructure.

- Tokenize Money Market Funds (MMFs) and Related RWAs Pursue tokenization of cash-equivalent, short-term products such as MMFs. Wavebridge manages compliance and investor onboarding; Solana supplies issuance and asset-servicing technology—aligned with global precedents like BlackRock’s on-chain MMF pilots.

- Support Korean Commercial Banks Run programs for major banks on on-chain settlement, remittances, and tokenized deposits. Wavebridge coordinates with domestic banks, while ecosystem partners integrate on Solana.

- Expand the Web3 Ecosystem Explore new initiatives in payments, consumer apps, and GameFi. Wavebridge provides regulated infrastructure for Solana’s broad developer ecosystem and network.

Wavebridge, licensed as a Virtual Asset Service Provider (VASP) in Korea, will take the lead in regulatory coordination, compliance, and qualified investor onboarding. Wavebridge will leverage Solana’s blockchain infrastructure, ecosystem developers' strong technical expertise, and the network's global reach. Together, Wavebridge on Solana seeks to establish the infrastructure for digital assets that are usable, trustworthy, and aligned with Korea’s financial regulatory framework.

“This collaboration is about designing structures where a KRW stablecoin is not only issued but also verified, controlled, and fit for institutional use,” said Jongwook Oh, CEO of Wavebridge. “By building on Solana, we aim to establish an infrastructure that even regulated financial institutions can rely on.”

Lily Liu, President of the Solana Foundation, added: “Combining Wavebridge’s regulatory expertise with Solana’s global ecosystem enables new real-world use cases for stablecoins and MMF tokenization. We believe this is an important step toward expanding digital asset adoption in financial markets.”