[Wavebridge × Factblock Research_KBW 2025] From a Retail Powerhouse to Institutional Finance

![[Wavebridge × Factblock Research_KBW 2025] From a Retail Powerhouse to Institutional Finance](/content/images/size/w1200/2025/10/-------1.png)

Wavebridge, in partnership with KBW organizer Factblock, has released a joint research report during the 2025 Korea Blockchain Week. The study highlights how Korea is transitioning from being a global retail powerhouse into a regulated financial infrastructure hub — with Bitcoin spot ETFs and KRW-based stablecoins at the center of this transformation.

1. Korea Emerging as Asia’s True Strategic Hub

The mood at KBW 2025 was clear: global capital is starting to see Korea differently. With nearly a decade of industry experience, Wavebridge observed a decisive shift in perception on the ground.

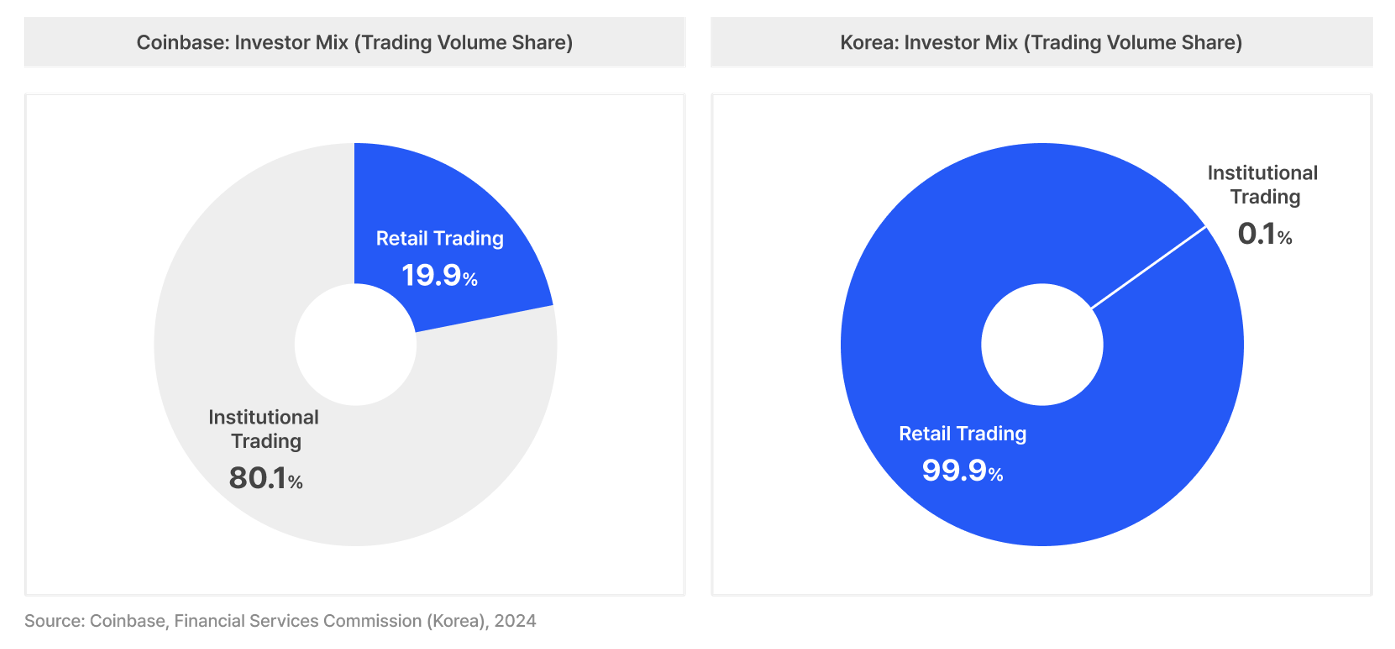

Korea was one of the first countries worldwide to implement real-name bank accounts for digital assets, taking the lead in regulatory soundness. Unlike other countries where institutional capital has driven adoption, Korea’s market has been fueled by direct retail demand in KRW, generating over KRW 2,500 trillion(USD 1.8 trillion) in annual spot trading volume.

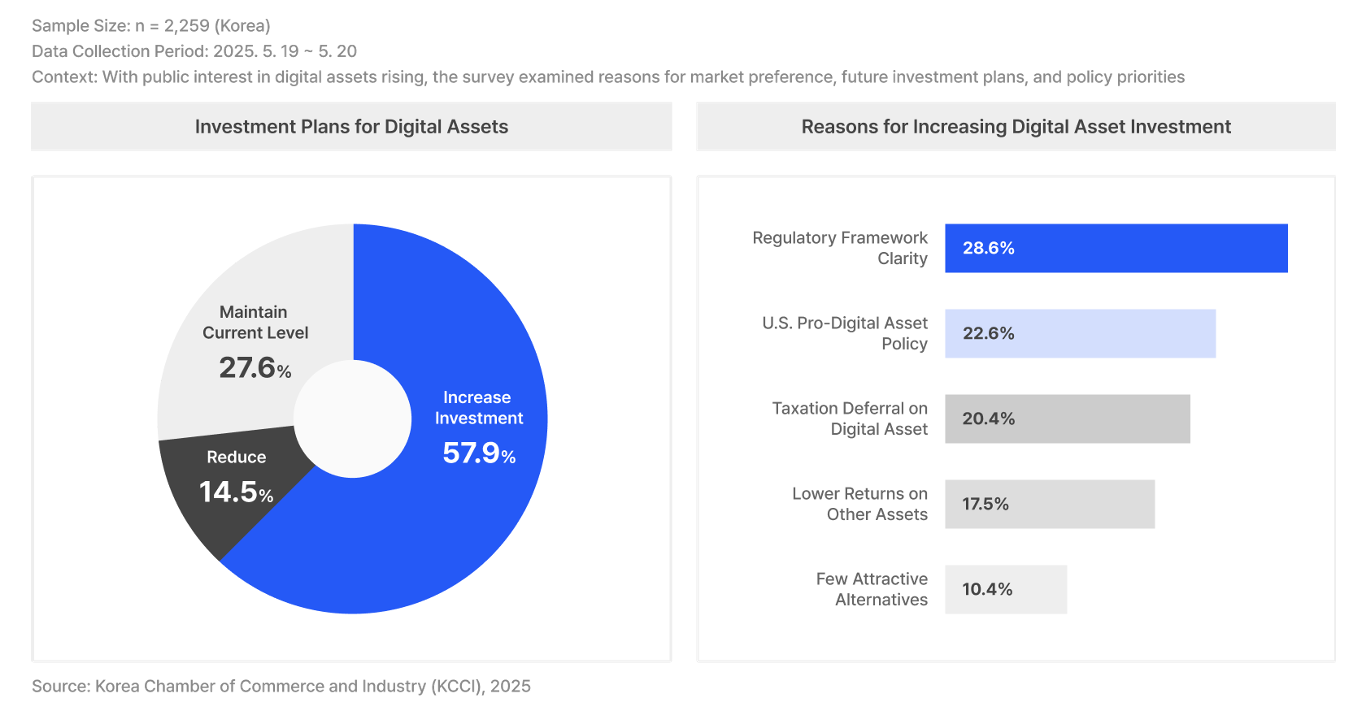

This has created a robust ecosystem encompassing AML and investor protection frameworks, high-performance trading infrastructure, and legal, accounting, and tax expertise — positioning Korea as a global benchmark. Today, 9.7 million Koreans (32% of the population) are active crypto investors, nearly 4.7 times the global average ownership rate (6.8%). A recent survey also showed that 57.9% plan to increase their investments, with the top reason cited as “regulatory clarity on the horizon” (28.6%).

In other words, Korea’s market is maturing beyond speculation, underpinned by strong retail demand and regulatory stability. And two themes stand out: Bitcoin spot ETFs and KRW-based stablecoins.

2. Bitcoin Spot ETFs: The Institutional Gateway Beyond Retail

Globally, Bitcoin spot ETFs have already grown into a $130 billion (KRW 180 trillion) market, with Hong Kong, the UK, and other major financial countries granting approvals.

In Korea:

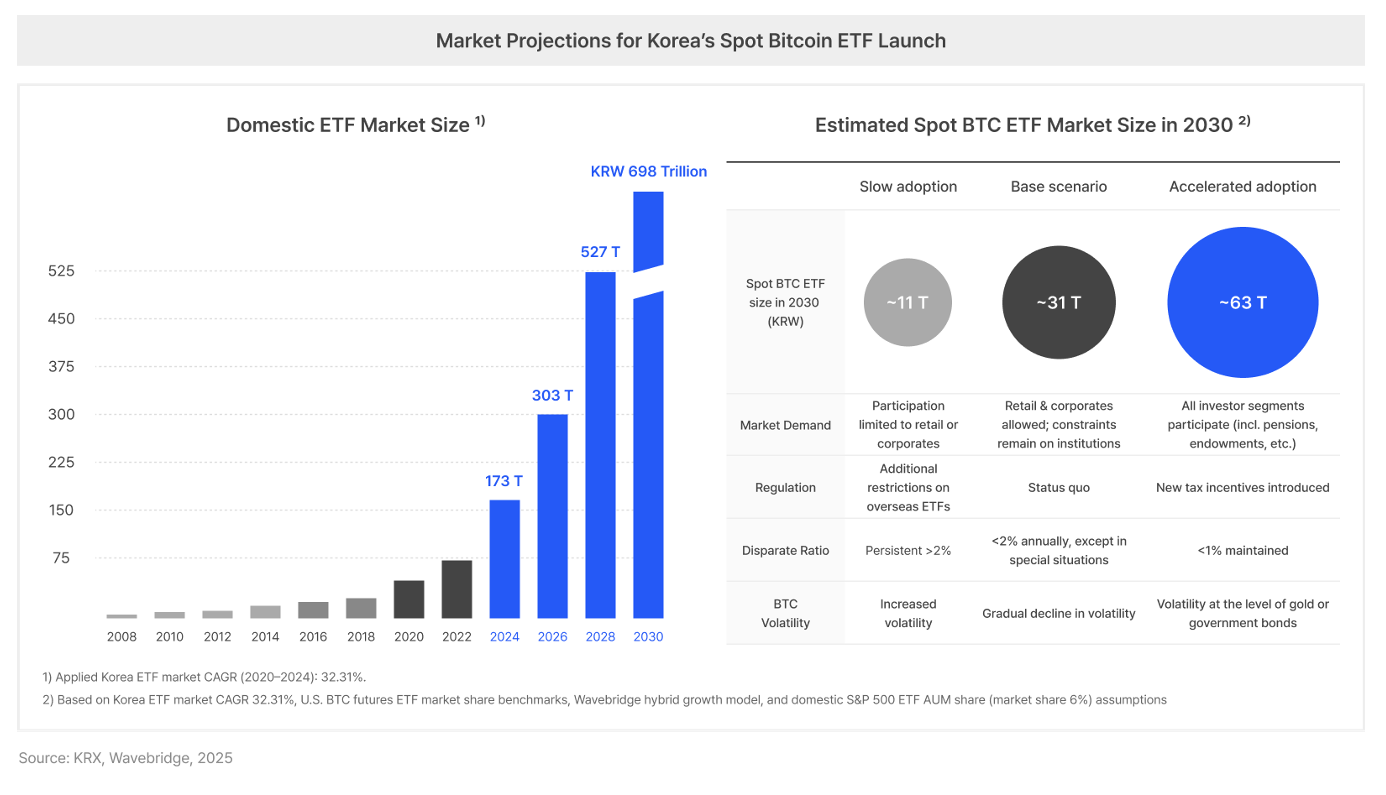

- Operational expertise: Domestic ETF issuers already manage a KRW 170 trillion(USD 124 billion) ETF market, with proven capabilities in product design and investor services.

- Massive underlying market: Domestic crypto trading volume has reached KRW 1,345 trillion, surpassing KOSPI.

Wavebridge projects Korea's Bitcoin spot ETF market could reach KRW 63 trillion by 2030:

- ~KRW 63 trillion(USD 46 billion) if full institutional entry (pension funds, endowments, etc.) is allowed

- ~KRW 31 trillion(USD 22.6 billion) with partial institutional participation

- ~KRW 11 trillion(USD 8 billion) if limited to retail and corporates

Bitcoin spot ETFs are not just another investment vehicle — they will act as a catalyst for both retail-to-institutional migration and wider adoption. Benefits include:

- Convenience: Tradable through existing brokerage accounts with simplified tax reporting

- Supervision: Full integration into the Financial Supervisory Service’s framework

- Security: Assets held by trust banks under regulatory oversight

This marks the crossroads where retail transitions to regulated ETF exposure and institutions begin their full-scale entry. In time, derivatives markets may also emerge as a natural next step for risk management.

3. Stablecoins: The Next Infrastructure for Payments and Remittances

While the U.S. and Europe are leading the way with established stablecoin regimes, Korea is just beginning its regulatory discussions. Yet its fundamentals are uniquely strong.

- Crypto adoption base: 9.7 M real-name crypto accounts, with KRW 7.3 trillion(USD 5.3 billion) traded daily.

- Payments powerhouse: KakaoPay (40M users), NaverPay (31M), and Toss (30M) anchor a massive digital payments ecosystem.

Together, these form fertile ground for KRW-based stablecoins. Potential benefits include:

- Investor protection: Stablecoins transacted through real-name accounts within regulated frameworks

- Cheaper remittances: Cutting 1–3% traditional fees with real-time cross-border transfers

- Faster settlements: From D+2~3 to near-instant liquidity for merchants

- Lower payment fees: Card fees of 0.4–1.5% could be significantly reduced

Challenges remain, such as alignment with the Bank of Korea’s CBDC program, regulatory coordination among agencies, and harmonization with global frameworks (MiCA, GENIUS Act). Still, stablecoins are not just an industry agenda — they represent a systemic need for greater financial efficiency.

4. How to Enter Korea’s Digital Asset Market

Taken together, these dynamics show just how attractive Korea’s digital asset market is. Genuine retail demand already exists, and institutional frameworks are now being put in place. The question is no longer if the market will expand — but how.

For foreign entrants, strategic planning is essential. Four key points stand out:

(1) VASP License vs. Partnerships

Strategic partnerships: Enable immediate entry by leveraging existing VASP infrastructure and spreading regulatory risk. In practice, this phased, partnership-first approach is the most realistic.

New VASP license: Provides independence and brand control but typically requires over one year and at least KRW 5 billion(USD 3.65 million) in setup costs (staffing, IT, AML, real-name banking).

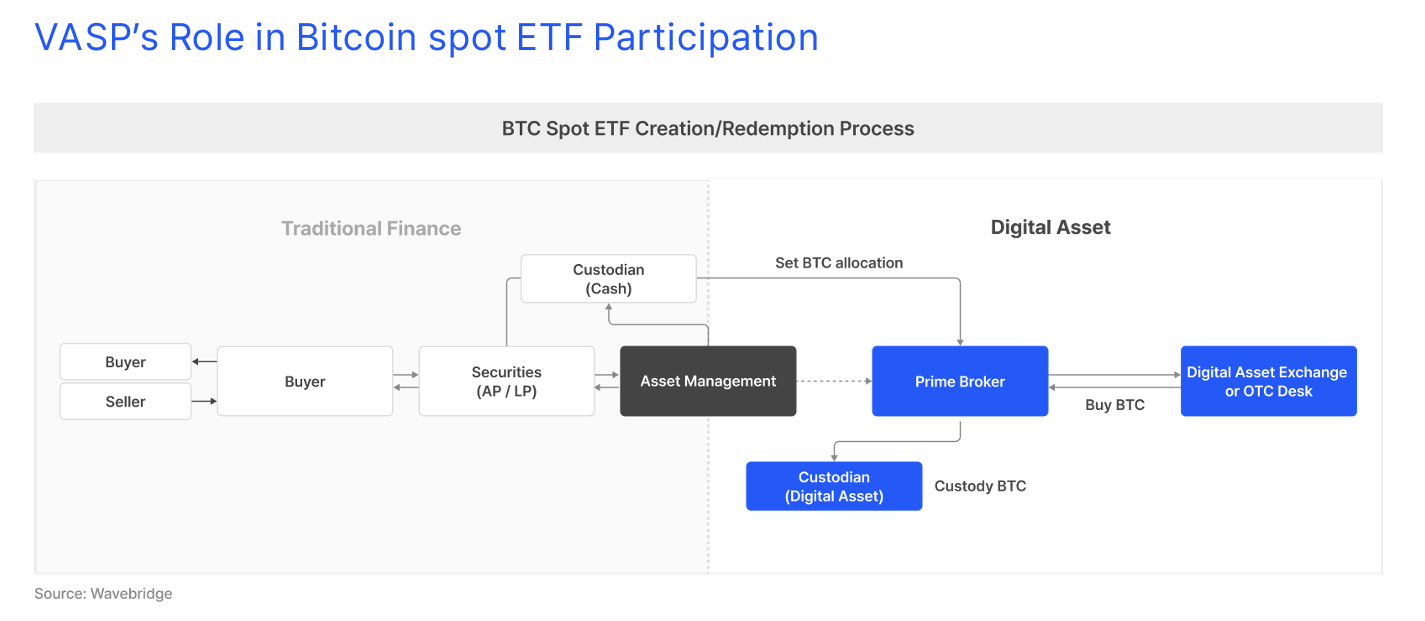

(2) VASP’s Role in Bitcoin Spot ETFs

Relying solely on exchanges risks conflicts of interest — independent prime brokers and custodians are required.

Beyond issuance and distribution, VASPs are essential for physical Bitcoin creation/redemption, large-scale custody, and institutional liquidity provision.

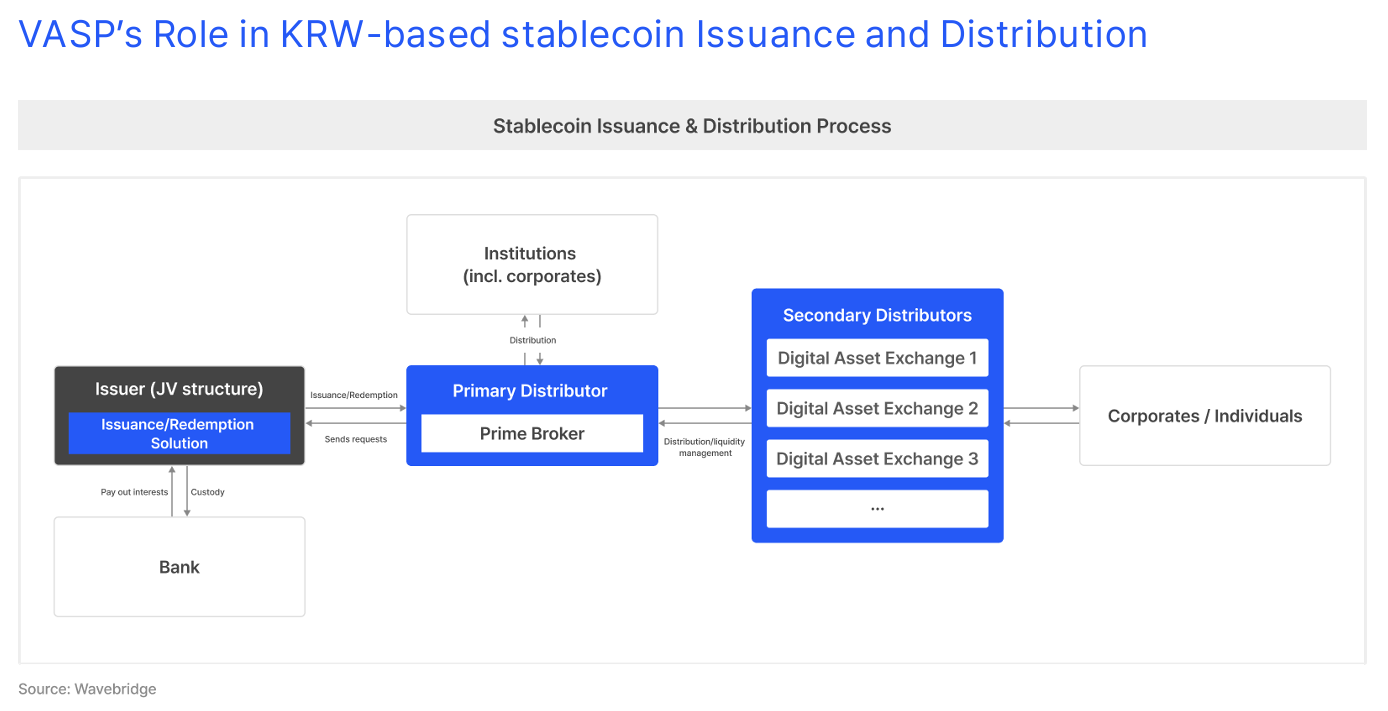

(3) VASP’s Role in KRW Stablecoin Ecosystems

- Exchanges: Facilitate retail and small-scale transactions

- Custodians: Safekeep reserves and verify circulation vs. backing assets

- Prime brokers: Handle mint/burn processes and institutional block trades

Korea is moving toward a dual structure: bank-led JV issuers + digital asset distributors.

(4) A Phased Market Entry Strategy

- Long-term: Secure independent VASP licensing and institutional-grade positioning

- Mid-term: Strengthen operations in line with regulatory and banking requirements

- Short-term: Enter via partnerships, validate performance

Conclusion

For global firms considering entry, Korea offers a rare combination of proven retail demand and emerging institutional clarity.

Wavebridge is ready to serve as a trusted partner — combining regulatory alignment, infrastructure expertise, and global perspective — to help institutions navigate Korea’s pivotal crypto shift and grow together in this expanding market.